The Processes of Globalisation

Boaventura de Sousa Santos

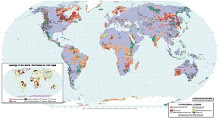

What is the current state of globalisation, how are we to understand the processes involved and where will a globalised world system lead us? These are some of the questions Boaventura de Sousa Santos aims to elucidate in a thorough and wide ranging essay. Arguing that our current globalisation is indeed something unparalleled in history, Santos discusses the unequal economic and political realities between North and South which globalisation enforces. Globalisation is to be understood as a non-linear process marked by contradictory yet parallel discourses and varying levels of intensity and speed. Even states however have to adopt as the supremacy of the nation state is eroded, giving way to new transnational alliances and the convergence of the judicial systems as the supreme regulator of a globalised economy. Will all these processes usher into a new model of social development, or will this lead to the crisis of the world system as others fear? Read the article at: http://www.eurozine.com/articles/2002-08-22-santos-en.html

Wednesday, December 30, 2009

Thursday, December 24, 2009

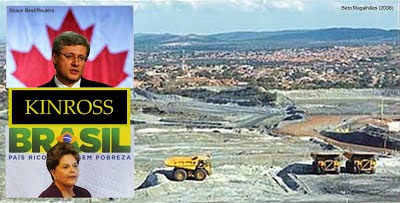

Kinross to greenwash cyanide

Kinross to greenwash cyanide

By Sergio U. Dani, from Göttingen, Germany, December 24, 2009

Kinross Gold Corporation, a transnational Canadian company that pollutes the environment, robs drinking water and kills people in Paracatu-MG, Brazil, has announced its new greenswashing move this Tuesday [1]. Kinross announces “Cyanide Management Certification” in its gold mines in the Americas and Russia. Stephen Odoi-Larbi has written about this greenwashing modality in Africa in a recent article [2] attached hereto. It reproduces to perfection the pathetical and notious greenwashing move as has been observed in Paracatu and elsewhere: polluting companies’ self regulation; violation of human rights, despise of nations’ sovereignty; wrong voluntary code of conduct; greenwashing intended to better the interest of the mining companies operating in countries.

Sources:

[1] http://www.kinross.com/news-articles/2009/kupol-becomes-first-mine-in-russia-to-obtain-icmi-environmental-certification-.aspx, accessed December 24, 2009.

[2] http://allafrica.com/stories/200910210070.html, accessed December 24, 2009.

Read attachment [2] here:

By Sergio U. Dani, from Göttingen, Germany, December 24, 2009

Kinross Gold Corporation, a transnational Canadian company that pollutes the environment, robs drinking water and kills people in Paracatu-MG, Brazil, has announced its new greenswashing move this Tuesday [1]. Kinross announces “Cyanide Management Certification” in its gold mines in the Americas and Russia. Stephen Odoi-Larbi has written about this greenwashing modality in Africa in a recent article [2] attached hereto. It reproduces to perfection the pathetical and notious greenwashing move as has been observed in Paracatu and elsewhere: polluting companies’ self regulation; violation of human rights, despise of nations’ sovereignty; wrong voluntary code of conduct; greenwashing intended to better the interest of the mining companies operating in countries.

Sources:

[1] http://www.kinross.com/news-articles/2009/kupol-becomes-first-mine-in-russia-to-obtain-icmi-environmental-certification-.aspx, accessed December 24, 2009.

[2] http://allafrica.com/stories/200910210070.html, accessed December 24, 2009.

Read attachment [2] here:

Friday, December 18, 2009

What is at stake in Copenhagen

A who-shall-die-last game? Or the ascent of a new kind of world leadership?

"Let us give good science, good systemic projects and good systemic leaders a chance to save our humanity by saving our planet."

Sergio U. Dani, from Göttingen, Germany, December 18, 2009

For those wondering why official politicians and negotiators are unable to set an agreement at Copenhagen, I offer a guess. Official politicians and negotiators are common sense thinkers backed by mainstream economy, industrial and financial institutions in their respective countries. They are created in a competitive system where money endows power, makes one strong to defeat weaker competitors. Since enough political money – and therefore enough political strength – is in possession of the rich, what most people aren’t, then conducting politics and negotiation has become an exclusive right of a fistful of rich and nouveau rich people.

A fistful of privileged rich people and institutions are intrinsically programmed to win competitions, not to lose them. They deal with global warming as if it was a competition as any other one. Their task, their default is to win this competition and keep growing. The reason why they are up to mischief is certainly this. There is no such thing as a growth competition when it comes to global warming and critically degrading resources. Global warming and environmental degradation have to be dealt with in their own rights. After all, global warming affects all of us, the rich and the poor, the intelligent and the fool, the beautiful and the ugly, the young and the elderly, the winners and the losers. Science of the environment has taught us that systemic changes do not abide by political rules or geographic frontiers.

Thursday, December 3, 2009

How do toxic chemicals move around the planet?

How do toxic chemicals move around the planet?

Read Elizabeth Grossman's article in Scientific American for awesome explanations.

Swimmers, hoppers and fliers: How do toxic chemicals move around the planet?

By Elizabeth Grossman

Toxic chemicals created by human activity reach unusual concentrations in the Arctic, among other places

http://www.scientificamerican.com/article.cfm?id=how-do-toxic-chemicals-move-around-planet&SID=mail&sc=emailfriend

World's top 10 most polluted places

Open cut gold mine at Paracatu-MG, Brazil: arsenic contamination and mass murder. Photo by Beto Magalhães, July 2008.

World's top 10 most polluted places

Where toxic pollution and human habitation collide with devastating effects

By David Biello

From the December 2007 special edition of Scientific American

Poisoned water haunts Bhopal 25 years after chemical accident

Poisoned water haunts Bhopal 25 years after chemical accident

By Sara Goodman

A new report says water contamination is worsening as chemicals leach through soil into the aquifer

Monday, November 30, 2009

A message for the people of Canada: Support “Bill C-300” and let us live our lives in health and peace!

A message for the people of Canada: Support “Bill C-300” and let us live our lives in health and peace!

A message for the people of Canada: Support “Bill C-300” and let us live our lives in health and peace!By Sergio U. Dani, from Göttingen, Germany, November 30, 2009

If you are a Canadian woman or man, you should know that 2 out of 3 extractive companies operating in the world are based in Canada. The reason for this astonishing concentration of mining, oil and gas companies in Canada can be hinted at in a recent report released by three Canadian gold mining companies [1]: “the international competitiveness of Canadian mining companies working in developing countries in a manner unique to Canada”.

Indeed, many Canadian companies receive taxpayer dollars of Canadian governmental investment. They also receive political and diplomatic support from the Canadian government to operate around the world, and they pretend to operate legally. Truth is, many of these companies operate massive environmental damages, displacement of local people from their homes as well as rapes and even murder. Did you know all that? Have you ever allowed your government and Canadian companies to operate like this, financed by the taxes you pay?

Thursday, November 19, 2009

Main ingredients in household dust come from outdoors

Main ingredients in household dust

come from outdoors

Arsenic and other particles tracked indoors can be harmful, researchers warn

By Robert Preidt, HealthDay

WEDNESDAY, Nov. 11, 2009 (HealthDay News) -- Most of the dust that coats your furniture and floors comes from outdoors and can pose a health threat, a new study suggests.

come from outdoors

Arsenic and other particles tracked indoors can be harmful, researchers warn

By Robert Preidt, HealthDay

WEDNESDAY, Nov. 11, 2009 (HealthDay News) -- Most of the dust that coats your furniture and floors comes from outdoors and can pose a health threat, a new study suggests.

Gold mining liabilities left for taxpayers to pay

Gold mining liabilities left

for taxpayers to pay

The Giant Mine was a large gold mine located on the Ingraham Trail just outside of Yellowknife, Northwest Territories, Canada. Mining operations at Giant Mine over five decades (from 1948 to early 2004) created a massive environmental liability, a problem which the mine's previous owners left to the Canadian and Northwest Territories governments to sort out.

for taxpayers to pay

The Giant Mine was a large gold mine located on the Ingraham Trail just outside of Yellowknife, Northwest Territories, Canada. Mining operations at Giant Mine over five decades (from 1948 to early 2004) created a massive environmental liability, a problem which the mine's previous owners left to the Canadian and Northwest Territories governments to sort out.

Giant Mine arsenic spill raises safety questions

Giant Mine arsenic spill raises safety questions

CBC News, October 2009. A recent arsenic spill at the defunct Giant Mine near Yellowknife is raising concerns about safety and the reporting of spills at mine sites.

CBC News, October 2009. A recent arsenic spill at the defunct Giant Mine near Yellowknife is raising concerns about safety and the reporting of spills at mine sites.

Dissolved arsenic in Bangladesh drinking water is from human alteration of landscape

Dissolved arsenic in Bangladesh drinking water is from human alteration of landscape

ScienceDaily (Nov. 16, 2009) — Researchers in MIT's Department of Civil and Environmental Engineering believe they have pinpointed a pathway by which arsenic may be contaminating the drinking water in Bangladesh, a phenomenon that has puzzled scientists, world health agencies and the Bangladeshi government for nearly 30 years. The research suggests that human alteration to the landscape, the construction of villages with ponds, and the adoption of irrigated agriculture are responsible for the current pattern of arsenic concentration underground.

ScienceDaily (Nov. 16, 2009) — Researchers in MIT's Department of Civil and Environmental Engineering believe they have pinpointed a pathway by which arsenic may be contaminating the drinking water in Bangladesh, a phenomenon that has puzzled scientists, world health agencies and the Bangladeshi government for nearly 30 years. The research suggests that human alteration to the landscape, the construction of villages with ponds, and the adoption of irrigated agriculture are responsible for the current pattern of arsenic concentration underground.

Tuesday, November 17, 2009

How can Canadian companies operate illegal mining worldwide?

How can Canadian companies operate illegal mining worldwide?

Picture: Mexican people demonstrate against Canadian mining company in Cerro de San Pedro

Sergio Ulhoa Dani, from Göttingen, Germany, November 10, 2009

The people of San Luis Potosí, Mexico, have been fighting an open pit gold mine in Cerro de San Pedro. Last year it became part of a larger company, New Gold Inc. ("New Gold", TSX and NYSE AMEX: NGD), who has been pretending that all is well and legal while continuing to operate illegally, the people of San Luis Potosí say.

The configuration is very similar to that of Paracatu, Brazil, where Canadian Kinross Gold Corporation (NYSE: KGC; TSX: K) operates a true genocide through the release of arsenic from its open cut gold mine located in the outskirts of the city, with the invaluable support of a fistful of government people.

But San Luis Pososí and Paracatu are not isolate cases. Some Canadian companies have been operating corruption and murdering plots worldwide. The Congo affair gained notoriety through the intervention of the UNO Secretary General.

Anthropogenic influences on groundwater arsenic concentrations in Bangladesh

A new article in Nature Geoscience points to the role of human-made ponds in releasing arsenic from Bangladesh's aquifers:

http://www.nature.com/ngeo/journal/vaop/ncurrent/abs/ngeo685.html

Nature Geoscience

Published online: 15 November 2009

Anthropogenic influences on groundwater arsenic concentrations in Bangladesh

Rebecca B. Neumann, Khandaker N. Ashfaque, A. B. M. Badruzzaman, M. Ashraf Ali, Julie K. Shoemaker & Charles F. Harvey

Abstract

The origin of dissolved arsenic in the Ganges Delta has puzzled researchers ever since the report of widespread arsenic poisoning two decades ago. Today, microbially mediated oxidation of organic carbon is thought to drive the geochemical transformations that release arsenic from sediments, but the source of the organic carbon that fuels these processes remains controversial. At a typical site in Bangladesh, where groundwater-irrigated rice fields and constructed ponds are the main sources of groundwater recharge, we combine hydrologic and biogeochemical analyses to trace the origin of contaminated groundwater. Incubation experiments indicate that recharge from ponds contains biologically degradable organic carbon, whereas recharge from rice fields contains mainly recalcitrant organic carbon. Chemical and isotopic indicators as well as groundwater simulations suggest that recharge from ponds carries this degradable organic carbon into the shallow aquifer, and that groundwater flow, drawn by irrigation pumping, transports pond water to the depth where dissolved arsenic concentrations are greatest. Results also indicate that arsenic concentrations are low in groundwater originating from rice fields. Furthermore, solute composition in arsenic-contaminated water is consistent with that predicted using geochemical models of pond-water–aquifer-sediment interactions. We therefore suggest that the construction of ponds has influenced aquifer biogeochemistry, and that patterns of arsenic contamination in the shallow aquifer result from variations in the source of water, and the complex three-dimensional patterns of groundwater flow.

http://www.nature.com/ngeo/journal/vaop/ncurrent/abs/ngeo685.html

Nature Geoscience

Published online: 15 November 2009

Anthropogenic influences on groundwater arsenic concentrations in Bangladesh

Rebecca B. Neumann, Khandaker N. Ashfaque, A. B. M. Badruzzaman, M. Ashraf Ali, Julie K. Shoemaker & Charles F. Harvey

Abstract

The origin of dissolved arsenic in the Ganges Delta has puzzled researchers ever since the report of widespread arsenic poisoning two decades ago. Today, microbially mediated oxidation of organic carbon is thought to drive the geochemical transformations that release arsenic from sediments, but the source of the organic carbon that fuels these processes remains controversial. At a typical site in Bangladesh, where groundwater-irrigated rice fields and constructed ponds are the main sources of groundwater recharge, we combine hydrologic and biogeochemical analyses to trace the origin of contaminated groundwater. Incubation experiments indicate that recharge from ponds contains biologically degradable organic carbon, whereas recharge from rice fields contains mainly recalcitrant organic carbon. Chemical and isotopic indicators as well as groundwater simulations suggest that recharge from ponds carries this degradable organic carbon into the shallow aquifer, and that groundwater flow, drawn by irrigation pumping, transports pond water to the depth where dissolved arsenic concentrations are greatest. Results also indicate that arsenic concentrations are low in groundwater originating from rice fields. Furthermore, solute composition in arsenic-contaminated water is consistent with that predicted using geochemical models of pond-water–aquifer-sediment interactions. We therefore suggest that the construction of ponds has influenced aquifer biogeochemistry, and that patterns of arsenic contamination in the shallow aquifer result from variations in the source of water, and the complex three-dimensional patterns of groundwater flow.

Friday, November 13, 2009

Metallomics opening new frontiers for brain research in Germany

Metallomics opening new frontiers for brain research in Germany

Sergio U. Dani, Germany, Tuesday 3, November, 2009.

BrainMet, a new lab dedicated to the bioimaging of metals in brain and metallomics is scheduled for opening on December 9 this year. The new lab has been set up at the Central Division for Chemical Analyses of the Research Centre Jülich, in Jülich, Germany.

BrainMet is led by Dr. J. Sabine Becker, a worldwide renowned pioneer and expert in the field of mass spectroscopy. Becker and her group are credited with creating and developing a novel elemental analytical LA-ICP-MS technique using the near field effect with spatial resolution at the nanometer scale.

“Since trace elements are involved in a number of metabolic and physiological processes in the human body, and their deficiency and excess may lead to different metabolic disorders, much attention is paid with respect to the spatial distribution and the local concentration of trace elements in tissues”, says Becker.

BrainMet will be opened with a colloquium. For more information and registration to the BrainMet Colloquium, contact Mrs. A. Wiebecke at:

Forschungszentrum Jülich GmbH

Zentralabteilung für Chemische Analysen (ZCH)

52425 Jülich

Tel.: [++49] (2461) 61-4263

Telefax: [++49] (2461) 61-2560

E-mail: a.wiebecke@fz-juelich.de

Sergio U. Dani, Germany, Tuesday 3, November, 2009.

BrainMet, a new lab dedicated to the bioimaging of metals in brain and metallomics is scheduled for opening on December 9 this year. The new lab has been set up at the Central Division for Chemical Analyses of the Research Centre Jülich, in Jülich, Germany.

BrainMet is led by Dr. J. Sabine Becker, a worldwide renowned pioneer and expert in the field of mass spectroscopy. Becker and her group are credited with creating and developing a novel elemental analytical LA-ICP-MS technique using the near field effect with spatial resolution at the nanometer scale.

“Since trace elements are involved in a number of metabolic and physiological processes in the human body, and their deficiency and excess may lead to different metabolic disorders, much attention is paid with respect to the spatial distribution and the local concentration of trace elements in tissues”, says Becker.

BrainMet will be opened with a colloquium. For more information and registration to the BrainMet Colloquium, contact Mrs. A. Wiebecke at:

Forschungszentrum Jülich GmbH

Zentralabteilung für Chemische Analysen (ZCH)

52425 Jülich

Tel.: [++49] (2461) 61-4263

Telefax: [++49] (2461) 61-2560

E-mail: a.wiebecke@fz-juelich.de

Thursday, November 12, 2009

MIMER Notes, November 9, 2009

Medawar Institute for Medical and Environmental Research (MIMER)

Acute and chronic toxicities of arsenic in selected mammals including man: some notes on doses and vulnerabilities

By Sergio Ulhoa Dani, November 9, 2009.

Acute mortality

Different mammal species have different susceptibilities to arsenic acute toxicity, as assessed by LD50 and LC50 [1-12]. The LD50 defines the oral lethal dose that will kill 50% of the tested animals that eat the substance; and the LC50 defines the inhaled lethal concentration that will kill 50% of the tested animals breathing the substance.

A sequence of increased arsenic vulnerability as assessed by LD50 (LC50 for cat) is as follows: mouse (Ca or Pb arsenate p.o., 145-794 mg/kg) < rat (Ca or Pb arsenate p.o., 20-763 mg/g) < cat (AsCl3 gas, 100-200 mg/m3) < rabbit (Ca or Pb arsenate p.o., 50-75 mg/kg) < dog (Ca or Pb arsenate p.o., 38 mg/kg) < human (arsenate p.o., 1 mg/kg).

The vulnerability sequence as derived LC50 values (30 min exposure time) would be as follows [13]: mouse (73-209 mg As/m3) < rat (5.3-534 mg As/m3) < rabbit (8.8-13 mg As/m3) < dog (10 mg As/m3) < cat (5.2-7.8 mg As/m3) < human (estimated 5 mg As/m3).

Chronic morbidity and mortality

Acute and chronic toxicities of arsenic in selected mammals including man: some notes on doses and vulnerabilities

By Sergio Ulhoa Dani, November 9, 2009.

Acute mortality

Different mammal species have different susceptibilities to arsenic acute toxicity, as assessed by LD50 and LC50 [1-12]. The LD50 defines the oral lethal dose that will kill 50% of the tested animals that eat the substance; and the LC50 defines the inhaled lethal concentration that will kill 50% of the tested animals breathing the substance.

A sequence of increased arsenic vulnerability as assessed by LD50 (LC50 for cat) is as follows: mouse (Ca or Pb arsenate p.o., 145-794 mg/kg) < rat (Ca or Pb arsenate p.o., 20-763 mg/g) < cat (AsCl3 gas, 100-200 mg/m3) < rabbit (Ca or Pb arsenate p.o., 50-75 mg/kg) < dog (Ca or Pb arsenate p.o., 38 mg/kg) < human (arsenate p.o., 1 mg/kg).

The vulnerability sequence as derived LC50 values (30 min exposure time) would be as follows [13]: mouse (73-209 mg As/m3) < rat (5.3-534 mg As/m3) < rabbit (8.8-13 mg As/m3) < dog (10 mg As/m3) < cat (5.2-7.8 mg As/m3) < human (estimated 5 mg As/m3).

Chronic morbidity and mortality

Monday, November 9, 2009

Global hazards of gold, coal and oil

Global hazards of gold, coal and oil

Present day anthropogenic arsenic emissions from gold, coal and oil

mining already surpass natural emissions from volcanic sources which

were linked to the extinction of dinosaurs in geological time. “This

is a change of paradigm of catastrophic proportions”, says Sergio

Dani, author of "Gold, coal and oil" on his article published in

Medical Hypotheses.

Arsenic ranks first in national and international lists of hazardous

substances. Colourless, odourless and tasteless arsenic has been

traditionally referred to and used as "the king of poisons". One tenth

of a gram is enough to kill an adult man within a few hours. Much

lesser quantities – something as the millionth part of a gram being

chronically inhaled or ingested over months or years – can cause

various types of cancer, vascular and renal diseases, neurological

diseases and diabetes among other diseases.

Source: Medawar Institute for Medical and Environmental

Research/Acangaú Foundation, October 2009.

Find out more about this story at:

www.alertaparacatu.blogspot.com

www.sosarsenic.blogspot.com

--

Sergio Ulhoa Dani, Dr.med., D.Sc. habil.

Göttingen, Germany

Tel. 00(XX)49 15-226-453-423

srgdani@gmail.com

Present day anthropogenic arsenic emissions from gold, coal and oil

mining already surpass natural emissions from volcanic sources which

were linked to the extinction of dinosaurs in geological time. “This

is a change of paradigm of catastrophic proportions”, says Sergio

Dani, author of "Gold, coal and oil" on his article published in

Medical Hypotheses.

Arsenic ranks first in national and international lists of hazardous

substances. Colourless, odourless and tasteless arsenic has been

traditionally referred to and used as "the king of poisons". One tenth

of a gram is enough to kill an adult man within a few hours. Much

lesser quantities – something as the millionth part of a gram being

chronically inhaled or ingested over months or years – can cause

various types of cancer, vascular and renal diseases, neurological

diseases and diabetes among other diseases.

Source: Medawar Institute for Medical and Environmental

Research/Acangaú Foundation, October 2009.

Find out more about this story at:

www.alertaparacatu.blogspot.com

www.sosarsenic.blogspot.com

--

Sergio Ulhoa Dani, Dr.med., D.Sc. habil.

Göttingen, Germany

Tel. 00(XX)49 15-226-453-423

srgdani@gmail.com

Gold, Coal and Oil

Gold, Coal and Oil

Neither the Three Wise Men's “Gold, Frankincense and Myrrh” nor Jared

Diamond´s “Guns, Germs and Steel”. "Gold, Coal and Oil" determine

mankind’s fate in a much more important and insidious way: the release

of arsenic, an invisible poison. This is the conclusion of an in-depth

study published in Europe by the journal Medical Hypotheses.

Source: Medawar Institute for Medical and Environmental

Research/Acangaú Foundation, October 2009.

Find out more about this story at:

www.alertaparacatu.blogspot.com

www.sosarsenic.blogspot.com

--

Sergio Ulhoa Dani, Dr.med., D.Sc. habil.

Göttingen, Germany

Tel. 00(XX)49 15-226-453-423

srgdani@gmail.com

Neither the Three Wise Men's “Gold, Frankincense and Myrrh” nor Jared

Diamond´s “Guns, Germs and Steel”. "Gold, Coal and Oil" determine

mankind’s fate in a much more important and insidious way: the release

of arsenic, an invisible poison. This is the conclusion of an in-depth

study published in Europe by the journal Medical Hypotheses.

Source: Medawar Institute for Medical and Environmental

Research/Acangaú Foundation, October 2009.

Find out more about this story at:

www.alertaparacatu.blogspot.com

www.sosarsenic.blogspot.com

--

Sergio Ulhoa Dani, Dr.med., D.Sc. habil.

Göttingen, Germany

Tel. 00(XX)49 15-226-453-423

srgdani@gmail.com

Tuesday, November 3, 2009

Gold, coal and oil: regulatory crisis of sizeable magnitude

Gold, coal and oil: regulatory crisis of sizeable magnitude

Whereas maximum allowed concentrations of arsenic in soils of some

countries such as Canada and Germany range from 5-50 milligrams/kg, in

some places of the world where soils have been contaminated by allowed

gold mining operations – e.g., Paracatu and Nova Lima, Brazil – or by

irrigation with arsenic-contaminated water – e.g. Bangladesh and West

Bengal – soil arsenic concentrations reach several grams/kg, that is,

thousand times the internationally maximal allowed concentrations.

Whereas maximum allowed concentrations of arsenic in soils of some

countries such as Canada and Germany range from 5-50 milligrams/kg, in

some places of the world where soils have been contaminated by allowed

gold mining operations – e.g., Paracatu and Nova Lima, Brazil – or by

irrigation with arsenic-contaminated water – e.g. Bangladesh and West

Bengal – soil arsenic concentrations reach several grams/kg, that is,

thousand times the internationally maximal allowed concentrations.

Kinross Gold Corporation: a history of bad management, facilitated corruption and mass murder.

By Sergio Ulhoa Dani, from Göttingen, Germany, Tuesday 3, November 2009

Canadian Kinross Gold Corporation (NYSE:KGC; TSX: K) has reported its third quarter 2009 results [1,2]. There was a net loss of US$21.5 million or US$0.03 per share, compared to net income of US$64.7 million or US$0.10 per share in the same quarter last year. The culprits are the “challenges at our Paracatu expansion project”, said Kinross CEO Tye Burt. To overcome these hurdles, Kinross has been diligently working to “facilitate” its business down the equator. Instead of cutting in its own flesh and fat, it is cutting in the health and lives of thousands of people in Paracatu, a 90,000 inhabitants city in the State of Minas Gerais, Brazil.

Canadian Kinross Gold Corporation (NYSE:KGC; TSX: K) has reported its third quarter 2009 results [1,2]. There was a net loss of US$21.5 million or US$0.03 per share, compared to net income of US$64.7 million or US$0.10 per share in the same quarter last year. The culprits are the “challenges at our Paracatu expansion project”, said Kinross CEO Tye Burt. To overcome these hurdles, Kinross has been diligently working to “facilitate” its business down the equator. Instead of cutting in its own flesh and fat, it is cutting in the health and lives of thousands of people in Paracatu, a 90,000 inhabitants city in the State of Minas Gerais, Brazil.

Kinross Gold Slips To Loss In Q3 - Quick Facts

Kinross Gold Slips To Loss In Q3 - Quick Facts

(RTTNews) - Kinross Gold Corp. (KGC: News ,K.TO: News ) reported that

its third-quarter net loss was US$21.5 million or US$0.03 per share,

compared to net income of US$64.7 million or US$0.10 per share in the

same quarter last year.

Adjusted net earnings were US$1.7 million or breakeven per share,

compared to US$83.4 million or US$0.13 per share for the same period

last year.

(RTTNews) - Kinross Gold Corp. (KGC: News ,K.TO: News ) reported that

its third-quarter net loss was US$21.5 million or US$0.03 per share,

compared to net income of US$64.7 million or US$0.10 per share in the

same quarter last year.

Adjusted net earnings were US$1.7 million or breakeven per share,

compared to US$83.4 million or US$0.13 per share for the same period

last year.

Canadian Kinross Gold Corporation operates corruption plots and a true genocide in Brazil

Canadian Kinross Gold Corporation operates corruption plots and a true genocide in Brazil

By Sergio Ulhoa Dani, from Göttingen, Germany, October 31, 2009

Kinross mining rights in Paracatu, a 90,000 inhabitants town in Brazil

were bought during the years 2003-2006 from Rio Tinto, one of the

biggest in the mining sector, for US$280 million – “a bargain” in the

words of Brazilian geologist Eupidio Reis. He was surprised by such a

low amount paid for the Brazilian biggest gold reserve, some 16

million ounces, standing for more than 60% of total Kinross’ proven

gold reserves. Eupidio Reis did not understand why the Paracatu mine,

valued at over US$10 billion at that time, could have been sold so

cheap.

By Sergio Ulhoa Dani, from Göttingen, Germany, October 31, 2009

Kinross mining rights in Paracatu, a 90,000 inhabitants town in Brazil

were bought during the years 2003-2006 from Rio Tinto, one of the

biggest in the mining sector, for US$280 million – “a bargain” in the

words of Brazilian geologist Eupidio Reis. He was surprised by such a

low amount paid for the Brazilian biggest gold reserve, some 16

million ounces, standing for more than 60% of total Kinross’ proven

gold reserves. Eupidio Reis did not understand why the Paracatu mine,

valued at over US$10 billion at that time, could have been sold so

cheap.

Friday, October 16, 2009

What's wrong with UNESCO

Nature 461, 447 (24 September 2009) | doi:10.1038/461447a; Published

online 23 September 2009

What's wrong with UNESCO

Abstract

The new director-general needs to buck all expectations and transform the agency.

As Nature went to press, Irina Gueorguieva Bokova, a Bulgarian diplomat, and Farouk Hosny, Egypt's minister of culture, faced off in a final electoral round to become director-general of the United Nations Educational, Scientific and Cultural Organization (UNESCO). The vote, by the agency's executive board, is subject to confirmation in October by its general conference.

BlackRock gets EU approval for buy of Barclays' BGI

BlackRock gets EU approval for buy of Barclays' BGI

REUTERS — September/23/2009

BRUSSELS, Sept 23 (Reuters) - U.S. fund manager BlackRock (Symbol : BLK) gained European Union regulatory approval on Wednesday for its acquisition of a Barclays (Symbol : BCS) investment unit for $13.5

billion in cash and shares.

The planned buy of Barclays Global Investors will elevate BlackRock (Symbol : BLK) to the world's largest money manager with $2.8 trillion of client funds. The new combined company will be called BlackRock

Global Investors.

REUTERS — September/23/2009

BRUSSELS, Sept 23 (Reuters) - U.S. fund manager BlackRock (Symbol : BLK) gained European Union regulatory approval on Wednesday for its acquisition of a Barclays (Symbol : BCS) investment unit for $13.5

billion in cash and shares.

The planned buy of Barclays Global Investors will elevate BlackRock (Symbol : BLK) to the world's largest money manager with $2.8 trillion of client funds. The new combined company will be called BlackRock

Global Investors.

Sunday, October 11, 2009

Kinross gold mine at Paracatu, Brasil: stuck in stone age

Kinross gold mine at Paracatu, Brasil: stuck in stone age

Sergio Ulhoa Dani

When it comes to members of the same family, comparisons are inevitable. One of the mines of the Kinross' family is Kettle River-Buckhorn, in Washington state, USA. Kinross' CEO Tye Burt is a proud father when he talks about this mine: “When you look at the Buckhorn Mine, you're looking at the future of mining", he said. Kinross' Paracatu Mine, in Minas Gerais state, Brazil, is a quite different issue. When you look at the Paracatu Mine, you're looking through the window of pre-historical times. The Kinross' gold mine at Paracatu is stuck in stone age.

Sergio Ulhoa Dani

When it comes to members of the same family, comparisons are inevitable. One of the mines of the Kinross' family is Kettle River-Buckhorn, in Washington state, USA. Kinross' CEO Tye Burt is a proud father when he talks about this mine: “When you look at the Buckhorn Mine, you're looking at the future of mining", he said. Kinross' Paracatu Mine, in Minas Gerais state, Brazil, is a quite different issue. When you look at the Paracatu Mine, you're looking through the window of pre-historical times. The Kinross' gold mine at Paracatu is stuck in stone age.

Dear David Kliegman,

Dear David Kliegman,

at the outset, let me forward to you and your Okanogan colleagues my sincere cumpliments on an excellent work done. We can appreciate your work very well since we are fighting the same fight, against the same culprits, down here in Brazil.

In Brazil, Kinross is slowly killing our creeks and the people of Paracatu, a 90,000 inhabitants town in northwestern Minas Gerais State. Kinross runs an open pit gold mine within the urban environment of Paracatu. Believe it or not, technically we are IN the open pit gold mine.

at the outset, let me forward to you and your Okanogan colleagues my sincere cumpliments on an excellent work done. We can appreciate your work very well since we are fighting the same fight, against the same culprits, down here in Brazil.

In Brazil, Kinross is slowly killing our creeks and the people of Paracatu, a 90,000 inhabitants town in northwestern Minas Gerais State. Kinross runs an open pit gold mine within the urban environment of Paracatu. Believe it or not, technically we are IN the open pit gold mine.

Environmental deal on Buckhorn gold mine brings jobs

Environmental deal on Buckhorn gold mine brings jobs

*Environmental deal on Buckhorn gold mine brings jobs*http://seattle.bizjournals.com/seattle/stories/2008/12/29/focus3.html

by Greg Lamm, Staff Writer

After nearly 20 years of legal hurdles and hundreds of millions of dollars in investments, ore is finally flowing out of the Buckhorn Mountain gold mine in Okanogan County.

For the next seven or eight years, trucks will haul up to 1,000 tons of ore a day to a mineral processing center about 50 miles away in Ferry County. When the deposit is depleted from the underground mine atop a 5,600-foot mountain near the Canadian border, mine owner Kinross Gold Corp. expects to have produced 1 million ounces of gold. That’s worth about $850 million at today’s price.

*Environmental deal on Buckhorn gold mine brings jobs*http://seattle.bizjournals.com/seattle/stories/2008/12/29/focus3.html

by Greg Lamm, Staff Writer

After nearly 20 years of legal hurdles and hundreds of millions of dollars in investments, ore is finally flowing out of the Buckhorn Mountain gold mine in Okanogan County.

For the next seven or eight years, trucks will haul up to 1,000 tons of ore a day to a mineral processing center about 50 miles away in Ferry County. When the deposit is depleted from the underground mine atop a 5,600-foot mountain near the Canadian border, mine owner Kinross Gold Corp. expects to have produced 1 million ounces of gold. That’s worth about $850 million at today’s price.

How Buckhorn mine opponent adapted to activist’s life

How Buckhorn mine opponent adapted to activist’s life

*How Buckhorn mine opponent adapted to activist’s life*http://seattle.bizjournals.com/seattle/stories/2008/12/29/focus4.html?q=BUCKHORN%20KINROSS

by Greg Lamm, Staff Writer

When Dave Kliegman launched his quest to block an open-pit gold mine on top of Buckhorn Mountain, his daughter was 10 years old.

Today, Sarah Kliegman is a year away from earning a Ph.D. in organic chemistry, and her father is still a passionate advocate for the Okanogan County wilderness area.

“I knew it was going to be a big battle,” said Dave Kliegman. “I really didn’t have any idea where it would end.”

Kliegman formed the Okanogan Highlands Alliance in 1992. He later quit his job as a physical and occupational therapist working with handicapped children to work full time on battling the open-pit mine. Along the way, he unraveled the hodgepodge of state regulations related to mining, became an expert on century-old federal mining law and also banded together with other grassroots organizations fighting mines in the West, including on Indian reservations.

*How Buckhorn mine opponent adapted to activist’s life*http://seattle.bizjournals.com/seattle/stories/2008/12/29/focus4.html?q=BUCKHORN%20KINROSS

by Greg Lamm, Staff Writer

When Dave Kliegman launched his quest to block an open-pit gold mine on top of Buckhorn Mountain, his daughter was 10 years old.

Today, Sarah Kliegman is a year away from earning a Ph.D. in organic chemistry, and her father is still a passionate advocate for the Okanogan County wilderness area.

“I knew it was going to be a big battle,” said Dave Kliegman. “I really didn’t have any idea where it would end.”

Kliegman formed the Okanogan Highlands Alliance in 1992. He later quit his job as a physical and occupational therapist working with handicapped children to work full time on battling the open-pit mine. Along the way, he unraveled the hodgepodge of state regulations related to mining, became an expert on century-old federal mining law and also banded together with other grassroots organizations fighting mines in the West, including on Indian reservations.

Refusing gold

Refusing gold

The Canadian Kinross Gold Corporation press release was efficient on spreading the news about Wilson Nelio Brumer to join the company Board of Directors, April this year. It was in the internet all over the world that on May 6, at the Toronto headquarters annual meeting that Brumer was to be voted and appointed.

Just two days passed on and “O Tempo”, a local Brazilian newspaper, in a now timid note headlined “Refusing Gold” quoted Wilson Brumer, a former Minas Gerais State Secretary, as being more interested to run his own business.

Brumer´s to be appointment had been interpreted as Kinross desperate try to place its Brazilian operation in the hands of someone with “easy transit and flow” within Government offices, someone with a known track record to sell valuable Brazilian assets to foreign groups. Kinross makes it public in its “Code of Ethics“ that “facilition payments” are due to government authorities in order to facilitate businesses in foreign countries.

Bottlenecked twice by two legal suits which prevent Kinross to build up a gigantic toxic tailings dam in the outskirts of the historical city of Paracatu, the mining company threatened to close doors at the beginning of this month. Sergio Dani, an M.D., PhD who presides the Acangau Foundation, a Brazilian non governmental foundation fighting a two-year long struggle to make Kinross pay for its debts in Paracatu said “the company representatives are crying crocodile tears as no company gets out of business for technical problems but rather for sheer incompetence”.

Kinross mining rights in Paracatu were bought in 2006 from Rio Tinto, one of the biggest in the mining sector, for just US $280 million – “a bargain” in the words of geologist Eupidio Reis, surprised by such a low amount paid for the Brazilian biggest gold reserve, some 16 million ounces, standing for more than 60% of total Kinross’ proven gold reserves. Eupidio Reis did not understand why the Paracatu mine, estimated in over US $10 billion, could be sold so cheap.

Truth is, what seemed to be a bargain for the Toronto dandies soon proved to be a nightmare. Sergio Dani explains that since 1987 the Paracatu gold mining project has been poorly planned and equally poorly managed, “Kinross invested a half billion dollars to scale up this mine production but all it got back was to make more evident the error, makeshift and blunder surrounding this expansion project” said Dani. The socio-economical and environmental damages lay open wide for anyone to see (see pics and videos at http://alertaparacatu.blogspot.com/ ).

In order to explore the world’s lowest grade ore (0.4 g/ton) the mining company disputes with local population and farmers huge volumes of precious fresh water, giving back in turn millions of tons of toxic debris – deposited into gigantic tailings dams built on the freshwater springs which meant to supply the city 90.000 inhabitants.

The regular mine explosions have been causing cracks in this historical city buildings and houses. One suspects that the toxic dust released from the open pit mine operations is responsible for increasing cancer incidence and other diseases in Paracatu.

The Paracatu mine ore is arsenopyrite which equals to say it liberates arsenic and sulphuric acid into the environment when mined and ground to have gold extracted. Arsenic is a cancer causing substance and sulphuric acid permeates and contaminates streams and groundwater.

Kinross accounting liabilities in Paracatu compete with the value of its gold reserves - bad news for any stockholder. One wonders if any stockholder would knowingly embark into an adventure that poses risk to his/her invested capital? Question is: how much do the stockholders really know about it?

Kinross tries hard to conceal its mistakes and disqualify Paracatu scientific community when offered a sustainable withdraw plan, as of 2007. “We do not tolerate a foreign company to name us as silly and idiots” warned Serrano Neves, Justice Prosecutor and the Fundacao Acangau Council Curator when challenged by the Canadian transnational mining company.

“Paracatu Kinross mining is stuck in stone age. Liabilities are gigantic and the fly-by-night risk are substancial”, adds Dani. “It comes as a “no surprise” that Mr. Brumer has refused a return ticket to travel back to the past of mining”, he concluded.

Brumer’s refusal to the invitation to take a seat at the Kinross Board of Directors opens room for speculations. Brumer served in Billinton, the first owner of the Paracatu mining site. Brumer welcomed the Rio Tinto-Kinross expansion project as a Minas Gerais State Secretary. Brumer did not say “ no thanks “ then. Presently, when the opposition to the mine expansion is strong, he appears to say: “Not now, thanks”.

No new director of Kinross Gold Corporation gets less than a US$100,000 monthly salary, plus compensations. Kinross CEO, Tye Burt, for example, has got US$10 million as salary and compensations in 2008. It is hard to tell whether Mr. Brumer would get as much in his own businesses in Brazil.

What has Brumer really refused?

Cylene Gama

Sources:

http://www.reuters.com/article/pressRelease/idUS239069+23-Apr-2009+MW20090423

http://www.otempo.com.br/otempo/colunas/?IdEdicao=1288&IdColunaEdicao=8485

http://www.alertaparacatu.blogspot.com/

http://www.kinross.com/corporate/pdf/management-information-circular.pdf

May 8, 2009

Paracatu-MG, Brazil

“Not now, thanks” (said Wilson Brumer, former State Secretary, refusing Kinross’ gold)The Canadian Kinross Gold Corporation press release was efficient on spreading the news about Wilson Nelio Brumer to join the company Board of Directors, April this year. It was in the internet all over the world that on May 6, at the Toronto headquarters annual meeting that Brumer was to be voted and appointed.

Just two days passed on and “O Tempo”, a local Brazilian newspaper, in a now timid note headlined “Refusing Gold” quoted Wilson Brumer, a former Minas Gerais State Secretary, as being more interested to run his own business.

Brumer´s to be appointment had been interpreted as Kinross desperate try to place its Brazilian operation in the hands of someone with “easy transit and flow” within Government offices, someone with a known track record to sell valuable Brazilian assets to foreign groups. Kinross makes it public in its “Code of Ethics“ that “facilition payments” are due to government authorities in order to facilitate businesses in foreign countries.

Bottlenecked twice by two legal suits which prevent Kinross to build up a gigantic toxic tailings dam in the outskirts of the historical city of Paracatu, the mining company threatened to close doors at the beginning of this month. Sergio Dani, an M.D., PhD who presides the Acangau Foundation, a Brazilian non governmental foundation fighting a two-year long struggle to make Kinross pay for its debts in Paracatu said “the company representatives are crying crocodile tears as no company gets out of business for technical problems but rather for sheer incompetence”.

Kinross mining rights in Paracatu were bought in 2006 from Rio Tinto, one of the biggest in the mining sector, for just US $280 million – “a bargain” in the words of geologist Eupidio Reis, surprised by such a low amount paid for the Brazilian biggest gold reserve, some 16 million ounces, standing for more than 60% of total Kinross’ proven gold reserves. Eupidio Reis did not understand why the Paracatu mine, estimated in over US $10 billion, could be sold so cheap.

Truth is, what seemed to be a bargain for the Toronto dandies soon proved to be a nightmare. Sergio Dani explains that since 1987 the Paracatu gold mining project has been poorly planned and equally poorly managed, “Kinross invested a half billion dollars to scale up this mine production but all it got back was to make more evident the error, makeshift and blunder surrounding this expansion project” said Dani. The socio-economical and environmental damages lay open wide for anyone to see (see pics and videos at http://alertaparacatu.blogspot.com/ ).

In order to explore the world’s lowest grade ore (0.4 g/ton) the mining company disputes with local population and farmers huge volumes of precious fresh water, giving back in turn millions of tons of toxic debris – deposited into gigantic tailings dams built on the freshwater springs which meant to supply the city 90.000 inhabitants.

The regular mine explosions have been causing cracks in this historical city buildings and houses. One suspects that the toxic dust released from the open pit mine operations is responsible for increasing cancer incidence and other diseases in Paracatu.

The Paracatu mine ore is arsenopyrite which equals to say it liberates arsenic and sulphuric acid into the environment when mined and ground to have gold extracted. Arsenic is a cancer causing substance and sulphuric acid permeates and contaminates streams and groundwater.

Kinross accounting liabilities in Paracatu compete with the value of its gold reserves - bad news for any stockholder. One wonders if any stockholder would knowingly embark into an adventure that poses risk to his/her invested capital? Question is: how much do the stockholders really know about it?

Kinross tries hard to conceal its mistakes and disqualify Paracatu scientific community when offered a sustainable withdraw plan, as of 2007. “We do not tolerate a foreign company to name us as silly and idiots” warned Serrano Neves, Justice Prosecutor and the Fundacao Acangau Council Curator when challenged by the Canadian transnational mining company.

“Paracatu Kinross mining is stuck in stone age. Liabilities are gigantic and the fly-by-night risk are substancial”, adds Dani. “It comes as a “no surprise” that Mr. Brumer has refused a return ticket to travel back to the past of mining”, he concluded.

Brumer’s refusal to the invitation to take a seat at the Kinross Board of Directors opens room for speculations. Brumer served in Billinton, the first owner of the Paracatu mining site. Brumer welcomed the Rio Tinto-Kinross expansion project as a Minas Gerais State Secretary. Brumer did not say “ no thanks “ then. Presently, when the opposition to the mine expansion is strong, he appears to say: “Not now, thanks”.

No new director of Kinross Gold Corporation gets less than a US$100,000 monthly salary, plus compensations. Kinross CEO, Tye Burt, for example, has got US$10 million as salary and compensations in 2008. It is hard to tell whether Mr. Brumer would get as much in his own businesses in Brazil.

What has Brumer really refused?

Cylene Gama

Sources:

http://www.reuters.com/article/pressRelease/idUS239069+23-Apr-2009+MW20090423

http://www.otempo.com.br/otempo/colunas/?IdEdicao=1288&IdColunaEdicao=8485

http://www.alertaparacatu.blogspot.com/

http://www.kinross.com/corporate/pdf/management-information-circular.pdf

The Trilateral Commission: Usurping Sovereignty

The Trilateral Commission: Usurping Sovereignty

The Trilateral Commission: Usurping Sovereignty

By Patrick Wood

http://www.augustreview.com/issues/globalization/the_trilateral_commission%3a_usurping_sovereignty_2007080373/

[Editor’s note: For ease of reading, all members of the Trilateral Commission appear in bold type]

“President Reagan ultimately came to understand Trilateral’s value and invited the entire membership to a reception at the White House in April 1984”

— David Rockefeller, Memoirs, 20021

According to each issue of the official Trilateral Commission quarterly magazine Trialogue:

The Trilateral Commission was formed in 1973 by private citizens of Western Europe, Japan and North America to foster closer cooperation among these three regions on common problems. It seeks to improve public understanding of such problems, to support proposals for handling them jointly, and to nurture habits and practices of working together among these regions.”2

Further, Trialogue and other official writings made clear their stated goal of creating a “New International Economic Order.” President George H.W. Bush later talked openly about creating a “New World Order”, which has since become a synonymous phrase.

This paper attempts to tell the rest of the story, according to official and unofficial Commission sources and other available documents.

The Trilateral Commission was founded by the persistent maneuvering of David Rockefeller and Zbigniew Brzezinski. Rockefeller was chairman of the ultra-powerful Chase Manhattan Bank, a director of many major multinational corporations and "endowment funds" and had long been a central figure in the Council on Foreign Relations (CFR). Brzezinski, a brilliant prognosticator of one-world idealism, was a professor at Columbia University and the author of several books that have served as "policy guidelines" for the Trilateral Commission. Brzezinski served as the Commission's first executive director from its inception in 1973 until late 1976 when he was appointed by President Jimmy Carter as Assistant to the President for National Security Affairs.

The initial Commission membership was approximately three hundred, with roughly one hundred each from Europe, Japan and North America. Membership was also roughly divided between academics, politicians and corporate magnates; these included international bankers, leaders of prominent labor unions and corporate directors of media giants.

The word commission was puzzling since it is usually associated with instrumentalities set up by governments. It seemed out of place with a so-called private group unless we could determine that it really was an arm of a government - an unseen government, different from the visible government in Washington. European and Japanese involvement indicated a world government rather than a national government. We hoped that the concept of a sub-rosa world government was just wishful thinking on the part of the Trilateral Commissioners. The facts, however, lined up quite pessimistically.

If the Council on Foreign Relations could be said to be a spawning ground for the concepts of one-world idealism, then the Trilateral Commission was the "task force" assembled to assault the beachheads. Already the Commission had placed its members in the top posts the U.S. had to offer.

President James Earl Carter, the country politician who promised, "I will never lie to you," was chosen to join the Commission by Brzezinski in 1973. It was Brzezinski, in fact, who first identified Carter as presidential timber, and subsequently educated him in economics, foreign policy, and the ins-and-outs of world politics. Upon Carter's election, Brzezinski was appointed assistant to the president for national security matters. Commonly, he was called the head of the National Security Council because he answered only to the president - some said Brzezinski held the second most powerful position in the U.S.

Carter's running mate, Walter Mondale, was also a member of the Commission. (If you are trying to calculate the odds of three virtually unknown men, out of over sixty Commissioners from the U.S., capturing the three most powerful positions in the land, don't bother. Your calculations will be meaningless.)

On January 7, 1977 Time Magazine, whose editor-in-chief, Hedley Donovan was a powerful Trilateral, named President Carter "Man of the Year." The sixteen-page article in that issue not only failed to mention Carter's connection with the Commission but also stated the following:

“As he searched for Cabinet appointees, Carter seemed at times hesitant and frustrated disconcertingly out of character. His lack of ties to Washington and the Party Establishment - qualities that helped raise him to the White House - carry potential dangers. He does not know the Federal Government or the pressures it creates. He does not really know the politicians whom he will need to help him run the country.”3

Is this portrait of Carter as a political innocent simply inaccurate or is it deliberately misleading? By December 25, 1976 - two weeks before the Time article appeared - Carter had already chosen his cabinet. Three of his cabinet members – Cyrus Vance, Michael Blumenthal, and Harold Brown - were Trilateral Commissioners; and the other non-Commission members were not unsympathetic to Commission objectives and operations. In addition, Carter had appointed another fourteen Trilateral Commissioners to top government posts, including:

C. Fred Bergsten (Under Secretary of Treasury)

James Schlesinger (Secretary of Energy)

Elliot Richardson (Delegate to Law of the Sea)

Leonard Woodcock (Chief envoy to China)

Andrew Young (Ambassador to the United Nations)

As of 25 December 1976, therefore, there were nineteen Trilaterals, including Carter and Mondale, holding tremendous political power. These presidential appointees represented almost one-third of the Trilateral Commission members from the United States. The odds of that happening “by chance” are beyond calculation!

Nevertheless, was there even the slightest evidence to indicate anything other than collusion? Hardly! Zbigniew Brzezinski spelled out the qualifications of a 1976 presidential winner in 1973:

“The Democratic candidate in 1976 will have to emphasize work, the family, religion and, increasingly, patriotism...The new conservatism will clearly not go back to laissez faire. It will be a philosophical conservatism. It will be a kind of conservative statism or managerism. There will be conservative values but a reliance on a great deal of co-determination between state and the corporations.”4

On 23 May 1976 journalist Leslie H. Gelb wrote in the not-so-conservative New York Times, "(Brzezinski) was the first guy in the Community to pay attention to Carter, to take him seriously. He spent time with Carter, talked to him, sent him books and articles, educated him."5

Richard Gardner (also of Columbia University) joined into the "educational" task, and as Gelb noted, between the two of them they had Carter virtually to themselves. Gelb continued: "While the Community as a whole was looking elsewhere, to Senators Kennedy and Mondale...it paid off. Brzezinski, with Gardner, is now the leading man on Carter's foreign policy task force."6

Although Richard Gardner was of considerable academic influence, it should be clear that Brzezinski was the "guiding light" of foreign policy in the Carter administration. Along with Commissioner Vance and a host of other Commissioners in the State Department, Brzezinski had more than continued the policies of befriending our enemies and alienating our friends. Since early 1977 we had witnessed a massive push to attain "normalized" relations with Communist China, Cuba, the USSR, Eastern European nations, Angola, etc. Conversely, we had withdrawn at least some support from Nationalist China, South Africa, Zimbabwe (formerly Rhodesia), etc. It was not just a trend - it was an epidemic. Thus, if it could be said that Brzezinski had, at least in part, contributed to current U.S. foreign and domestic policy, then we should briefly analyze exactly what he was espousing.

Needed: A More Just and Equitable World Order

The Trilateral Commission held their annual plenary meeting in Tokyo, Japan, in January 1977. Carter and Brzezinski obviously could not attend as they were still in the process of reorganizing the White House. They did, however, address personal letters to the meeting, which were reprinted in Trialogue, the official magazine of the Commission:

“It gives me special pleasure to send greetings to all of you gathering for the Trilateral Commission meeting in Tokyo. I have warm memories of our meeting in Tokyo some eighteen months ago, and am sorry I cannot be with you now.

“My active service on the Commission since its inception in 1973 has been a splendid experience for me, and it provided me with excellent opportunities to come to know leaders in our three regions.

“As I emphasized in my campaign, a strong partnership among us is of the greatest importance. We share economic, political and security concerns that make it logical we should seek ever-increasing cooperation and understanding. And this cooperation is essential not only for our three regions, but in the global search for a more just and equitable world order (emphasis added). I hope to see you on the occasion of your next meeting in Washington, and I look forward to receiving reports on your work in Tokyo.

“Jimmy Carter”7

Brzezinski's letter, in a similar vein, follows:

“The Trilateral Commission has meant a great deal to me over the last few years. It has been the stimulus for intellectual creativity and a source of personal satisfaction. I have formed close ties with new friends and colleagues in all three regions, ties which I value highly and which I am sure will continue.

“I remain convinced that, on the larger architectural issues of today, collaboration among our regions is of the utmost necessity. This collaboration must be dedicated to the fashioning of a more just and equitable world order (emphasis added). This will require a prolonged process, but I think we can look forward with confidence and take some pride in the contribution which the Commission is making.

“Zbigniew Brzezinski”8

The key phrase in both letters was "more just and equitable world order." Did this emphasis indicate that something was wrong with our present world order, that is, with national structures? Yes, according to Brzezinski, and since the present "framework" was inadequate to handle world problems, it must be done away with and supplanted with a world government.

In September 1974 Brzezinski was asked in an interview by the Brazilian newspaper Vega. "How would you define this new world order?" Brzezinski answered:

“When I speak of the present international system I am referring to relations in specific fields, most of all among the Atlantic countries; commercial, military, mutual security relations, involving the international monetary fund, NATO etc. We need to change the international system for a global system in which new, active and creative forces recently developed - should be integrated. This system needs to include Japan. Brazil, the oil producing countries, and even the USSR, to the extent which the Soviet Union is willing to participate in a global system.”9

When asked if Congress would have an expanded or diminished role in the new system, Brzezinski declared "...the reality of our times is that a modern society such as the U.S. needs a central coordinating and renovating organ which cannot be made up of six hundred people."10

Brzezinski developed background for the need for a new system in his book Between Two Ages: America's Role in the Technetronic Era (1969). He wrote that mankind has moved through three great stages of evolution, and was in the middle of the fourth and final stage. The first stage he described as "religious," combining a heavenly "universalism provided by the acceptance of the idea that man's destiny is essentially in God's hands" with an earthly "narrowness derived from massive ignorance, illiteracy, and a vision confined to the immediate environment."

The second stage was nationalism, stressing Christian equality before the law, which "marked another giant step in the progressive redefinition of man's nature and place in our world." The third stage was Marxism, which, said Brzezinski, "represents a further vital and creative stage in the maturing of man's universal vision." The fourth and final stage was Brzezinski's Technetronic Era, or the ideal of rational humanism on a global scale - the result of American-Communist evolutionary transformations.11

In considering our structure of governance, Brzezinski stated:

“Tension is unavoidable as man strives to assimilate the new into the framework of the old. For a time the established framework resiliently integrates the new by adapting it in a more familiar shape. But at some point the old framework becomes overloaded. The newer input can no longer be redefined into traditional forms, and eventually it asserts itself with compelling force. Today, though, the old framework of international politics - with their spheres of influence, military alliances between nation-states, the fiction of Sovereignty, doctrinal conflicts arising from nineteenth century crises - is clearly no longer compatible with reality.”12

One of the most important "frameworks" in the world, and especially to Americans, was the United States Constitution. It was this document that outlined the most prosperous nation in the history of the world. Was our sovereignty really "fiction"? Was the U.S. vision no longer compatible with reality? Brzezinski further stated:

“The approaching two-hundredth anniversary of the Declaration of Independence could justify the call for a national constitutional convention to reexamine the nation's formal institutional framework. Either 1976 or 1989 - the two- hundredth an anniversary of the Constitution - could serve as a suitable target date culminating a national dialogue on the relevance of existing arrangements... Realism, however, forces us to recognize that the necessary political innovation will not come from direct constitutional reform, desirable as that would be. The needed change is more likely to develop incrementally and less overtly...in keeping with the American tradition of blurring distinctions between public and private institution.”13

In Brzezinski's Technetronic Era then, the "nation-state as a fundamental unit of man's organized life has ceased to be the principal creative force: International banks and multinational corporations are acting and planning in terms that are far in advance of the political concepts of the nation-state."14

Brzezinski’s philosophy clearly pointed forward to Richard Gardner’s Hard Road to World Order that appeared in Foreign Affairs in 1974, where Gardner stated, "In short, the 'house of world order' would have to be built from the bottom up rather than from the top down. It will look like a great 'booming, buzzing confusion,' to use William James' famous description of reality, but an end run around national sovereignty, eroding it piece by piece, will accomplish much more than the old-fashioned frontal assault.”15

That former approach which had produced few successes during the 1950’s and 1960’s was being traded for a velvet sledge-hammer: It would make little noise, but would still drive the spikes of globalization deep into the hearts of many different countries around the world, including the United States. Indeed, the Trilateral Commission was the chosen vehicle that finally got the necessary traction to actually create their New World Order.

Understanding the philosophy of the Trilateral Commission was and is the only way we can reconcile the myriad of apparent contradictions in the information filtered through to us in the national press. For instance, how was it that the Marxist regime in Angola derived the great bulk of its foreign exchange from the offshore oil operations of Gulf Oil Corporation? Why did Andrew Young insist that "Communism has never been a threat to Blacks in Africa"? Why did the U.S. funnel billions in technological aid to the Soviet Union and Communist China? Why did the U.S. apparently help its enemies while chastising its friends?

A similar and perplexing question is asked by millions of Americans today: Why do we spend trillions on the “War on Terror” around the world and yet ignore the Mexican/U.S. border and the tens of thousands of illegal aliens who freely enter the U.S. each and every month?

These questions, and hundreds of others like them, cannot be explained in any other way: the U.S. Executive Branch (and related agencies) was not anti-Marxist or anti-Communist - it was and is, in fact, pro- Marxist. Those ideals which led to the heinous abuses of Hitler, Lenin, Stalin, and Mussolini were now being accepted as necessary inevitabilities by our elected and appointed leaders.

This hardly suggests the Great American Dream. It is very doubtful that Americans would agree with Brzezinski or the Trilateral Commission. It is the American public who is paying the price, suffering the consequences, but not understanding the true nature of the situation.

[Photo]

This nature however, was not unknown or unknowable. Senator Barry Goldwater (R-AZ) issued a clear and precise warning in his 1979 book, With No Apologies:

“The Trilateral Commission is international and is intended to be the vehicle for multinational consolidation of the commercial and banking interests by seizing control of the political government of the United States. The Trilateral Commission represents a skillful, coordinated effort to seize control and consolidate the four centers of power – political, monetary, intellectual and ecclesiastical.”16

Unfortunately, few heard and even fewer understood.

Follow the Money, Follow the Power

What was the economic nature of the driving force within the Trilateral Commission? It was the giant multinational corporations - those with Trilateral representation - which consistently benefited from Trilateral policy and actions. Polished academics such as Brzezinski, Gardner, Allison, McCracken, Henry Owen etc., served only to give "philosophical" justification to the exploitation of the world.

Don't underestimate their power or the distance they had already come by 1976. Their economic base was already established. Giants like Coca-Cola, IBM, CBS, Caterpillar Tractor, Bank of America, Chase Manhattan Bank, Deere & Company, Exxon, and others virtually dwarf whatever remains of American businesses. The market value of IBM's stock alone, for instance, was greater than the value of all the stocks on the American Stock Exchange. Chase Manhattan Bank had some fifty thousand branches or correspondent banks throughout the world. What reached our eyes and ears was highly regulated by CBS, the New York Times, Time magazine, etc.

The most important thing of all is to remember that the political coup de grace preceded the economic coup de grace. The domination of the Executive Branch of the U.S. government provided all the necessary political leverage needed to skew U.S. and global economic policies to their own benefit.

By 1977, the Trilateral Commission had notably become expert at using crises (and creating them in some instances) to manage countries toward the New World Order; yet, they found menacing backlashes from those very crises.

In the end, the biggest crisis of all was that of the American way of life. Americans never counted on such powerful and influential groups working against the Constitution and freedom, either inadvertently or purposefully, and even now, the principles that helped to build this great country are all but reduced to the sound of meaningless babblings.

Trilateral Entrenchment: 1980-2007

From left: Peter Sutherland, Sadako Ogata, Zbigniew Brzezinski, Paul Volcker, David Rockefeller. (25th Anniversary, New York, Dec. 1, 1998. Source: Trilateral Commission)

It would have been damaging enough if the Trilateral domination of the Carter administration was merely a one-time anomaly; but it was not!

Subsequent presidential elections brought George H.W. Bush (under Reagan), William Jefferson Clinton, Albert Gore and Richard Cheney (under G. W. Bush) to power.

Thus, every Administration since Carter has had top-level Trilateral Commission representation through the President or Vice-president, or both!

It is important to note that Trilateral domination has transcended political parties: they dominated both the Republican and Democrat parties with equal aplomb.

In addition, the Administration before Carter was very friendly and useful to Trilateral doctrine as well: President Gerald Ford took the reins after President Richard Nixon resigned, and then appointed Nelson Rockefeller as his Vice President. Neither Ford nor Rockefeller were members of the Trilateral Commission, but Nelson was David Rockefeller’s brother and that says enough. According to Nelson Rockefeller’s memoirs, he originally introduced then-governor Jimmy Carter to David and Brzezinski.

How has the Trilateral Commission effected their goal of creating a New World Order or a New International Economic Order? They seated their own members at the top of the institutions of global trade, global banking and foreign policy.

For instance, the World Bank is one of the most critical mechanisms in the engine of globalization.17 Since the founding of the Trilateral Commission in 1973, there have been only seven World Bank presidents, all of whom were appointed by the President. Of these seven, six were pulled from the ranks of the Trilateral Commission!

Robert McNamara (1968-1981)

A.W. Clausen (1981-1986)

Barber Conable (1986-1991)

Lewis Preston (1991-1995)

James Wolfenson (1995-2005)

Paul Wolfowitz (2005-2007)

Robert Zoellick (2007-present)

Another good evidence of domination is the position of U.S. Trade Representative (USTR), which is critically involved in negotiating the many international trade treaties and agreements that have been necessary to create the New International Economic Order. Since 1977, there have been ten USTR’s appointed by the President. Eight have been members of the Trilateral Commission!

Robert S. Strauss (1977-1979)

Reubin O'D. Askew (1979-1981)

William E. Brock III (1981-1985)

Clayton K. Yeutter (1985-1989)

Carla A. Hills (1989-1993)

Mickey Kantor (1993-1997)

Charlene Barshefsky (1997-2001)

Robert Zoellick (2001-2005)

Rob Portman (2005-2006)

Susan Schwab (2006-present)

This is not to say that Clayton Yeuter and Rob Portman were not friendly to Trilateral goals, because they clearly were.

The Secretary of State cabinet position has seen its share of Trilaterals as well: Henry Kissinger (Nixon, Ford), Cyrus Vance (Carter), Alexander Haig (Reagan), George Shultz (Reagan), Lawrence Eagleburger (G.H.W. Bush), Warren Christopher (Clinton) and Madeleine Albright (Clinton) There were some Acting Secretaries of State that are also noteworthy: Philip Habib (Carter), Michael Armacost (G.H.W. Bush), Arnold Kantor (Clinton), Richard Cooper (Clinton).

Lastly, it should be noted that the Federal Reserve has likewise been dominated by Trilaterals: Arthur Burns (1970-1978), Paul Volker (1979-1987), Alan Greenspan (1987-2006). While the Federal Reserve is a privately-owned corporation, the President “chooses” the Chairman to a perpetual appointment. The current Fed Chairman, Ben Bernanke, is not a member of the Trilateral Commission, but he clearly is following the same globalist policies as his predecessors.

The point raised here is that Trilateral domination over the U.S. Executive Branch has not only continued and but has been strengthened from 1976 to the present. The pattern has been deliberate and persistent: Appoint members of the Trilateral Commission to critical positions of power so that they can carry out Trilateral policies.

The question is and has always been, do these policies originate in consensus meetings of the Trilateral Commission where two-thirds of the members are not U.S. citizens? The answer is all too obvious.

Trilateral-friendly defenders attempt to sweep criticism aside by suggesting that membership in the Trilateral Commission is incidental, and that it only demonstrates the otherwise high quality of appointees. Are we to believe that in a country of 300 million people only these 100 or so are qualified to hold such critical positions? Again, the answer is all too obvious.

Where Does the Council on Foreign Relations Fit?

While virtually all Trilateral Commission members from North America have also been members of the CFR, the reverse is certainly not true. It is easy to over-criticize the CFR because most of its members seem to fill the balance of government positions not already filled by Trilaterals.

The power structure of the Council is seen in the makeup of its board of directors: No less than 44 percent (12 out of 27) are members of the Commission! If director participation reflected only the general membership of the CFR, then only 3-4 percent of the board would be Trilaterals.18

Further, the president of the CFR is Richard N. Haass, a very prominent Trilateral member who also served as Director of Policy Planning for the U.S. Department of State from 2001-2003.

Trilateral influence can easily be seen in policy papers produced by the CFR in support of Trilateral goals.

For instance, the 2005 CFR task force report on the Future of North America was perhaps the major Trilateral policy statement on the intended creation of the North American Union. Vice-chair of the task force was Dr. Robert A. Pastor, who has emerged as the “Father of the North American Union” and has been directly involved in Trilateral operations since the 1970’s. While the CFR claimed that the task force was “independent,” careful inspection of those appointed reveal that three Trilaterals were carefully chosen to oversee the Trilateral position, one each from Mexico, Canada and the United States: Luis Rubio, Wendy K. Dobson and Carla A. Hills, respectively.19 Hills has been widely hailed as the principal architect of the North American Free Trade Agreement (NAFTA) that was negotiated under President George H.W. Bush in 1992.

The bottom line is that the Council on Foreign Relations, thoroughly dominated by Trilaterals, serves the interests of the Trilateral Commission, not the other way around!

Trilateral Globalization in Europe

The content of this paper thus far suggests ties between the Trilateral Commission and the United States. This is not intended to mean that Trilaterals are not active in other countries as well. Recalling the early years of the Commission, David Rockefeller wrote in 1998,

“Back in the early Seventies, the hope for a more united EUROPE was already full-blown – thanks in many ways to the individual energies previously spent by so many of the Trilateral Commission’s earliest members.” [Capitals in original]20

Thus, since 1973 and in parallel with their U.S. Hegemony, the European members of the Trilateral Commission were busy creating the European Union. In fact, the EU's Constitution was authored by Commission member Valéry Giscard d'Estaing in 2002-2003, when he was President of the Convention on the Future of Europe. [For more on the EU, see European Union: Dictatorship Rising? and The Globalization Strategy: America and Europe in the Crucible]

The steps that led to the creation of the European Union are unsurprisingly similar to the steps being taken to create the North American Union today. As with the EU, lies, deceit and confusion are the principal tools used to keep an unsuspecting citizenry in the dark while they forge ahead without mandate, accountability or oversight. [See The Globalization Strategy: America and Europe in the Crucible and Toward a North American Union]

Conclusion

It is clear that the Executive Branch of the U.S. was literally hijacked in 1976 by members of the Trilateral Commission, upon the election of President Jimmy Carter and Vice-President Walter Mondale. This near-absolute domination, especially in the areas of trade, banking, economics and foreign policy, has continued unchallenged and unabated to the present.